[The following is the text of an Internet Sermon that was published on YouTube November 7, 2009.]

Hello, good evening and welcome, Shalom, Assalamu alaikum. It is November 2009, my name is Alexander Baron, I am an independent researcher based in London, England, and this is Internet Sermon number six from me.

The photograph you saw at the beginning of this video is not me but Mahmoud Ahmadinejad, the greatest statesman of our age. It’s there purely because I’m having problems with my Webcam, and can’t show you my ugly mug, so you’re gonna be listening to a blank screen, but it’s not important that you see my face, it is important though that you listen to what I say.

In a speech made to the Conservative Party Conference in Manchester on October 5, 2009, Mayor of London Boris Johnson addressed his audience in the following terms: “never forget, all you...banker bashers, never forget that the leper colony in the City of London produces nine per cent of UK GDP...and taxes that pay for roads and schools and hospitals across this country.”

I hope to convince you in this short dissertation that Boris was talking complete and utter rubbish, that the City of London produces absolutely

nothing of value for this country – or at least, nothing that can’t be done far more efficiently for a tiny fraction of the cost on your home computer – and that this is true not simply of the Square Mile, but of every financial centre in every nation throughout the world: Wall Street, Hong Kong, Tokyo, every financial centre great and small. I hope to convince you that we can, if we have the will, and in a very few years, shut down ninety-five percent or more of all financial institutions not only in Britain but throughout the world, and that this will save not only hundreds of billions of dollars for these economies every year, but will lead to an enormous drop in the demand for power – electricity and oil in particular. And that at the same time it will lead to a spectacular increase in real wealth not just for us here in Britain, or in the West, or in the so-called tiger economies of the Far East, but for every citizen of every country on the face of this planet.

In 1992, I published a somewhat whimsical pamphlet called Windows 3.1 And The End Of War. This was inspired by George Weiss, who is better known as Captain Rainbow of the Rainbow Alliance. If I recall, I first met him sitting on the steps of the London School of Economics. His idea – seemingly outlandish at the time – was that we should abolish Parliament and run the country by direct election, referendum, voting and initiative – all by computer. This idea doesn’t sound half so outlandish today when almost every citizen has access to the Internet, most of us in our own homes, and where most of us use it regularly.

The abolition of Parliament may still be a long way off, and indeed may never happen, but the British Government, the American Government, and many other governments not only allow but encourage direct citizen participation by such things as e-petitions, and the extension of official publications, and national and local government services on-line.

My proposal is that we extend this to banking. Let’s for the moment leave stocks and shares, unit trusts, hedge funds and so on, and concentrate on straightforward banking.

The first thing to note is that a great deal of banking and other financial activity is already carried out on-line. Many people pay rates, utilities and other services on-line. They book travel tickets and purchase all manner of goods and services on-line. There are even banks that trade exclusively on-line.

Banks are a development from the goldsmiths. At one time if you wanted to keep your money safe, you had to put it in a strongroom, ie you lodged it with the local goldsmith. And in time, the goldsmiths began issuing receipts – paper currency, IOUs, cheques – to allow people to spend their gold without taking physical possession of it. Nowadays, most money exists as credit. I use the word exists rather loosely, because credit has no tangible existence; it used to be represented by figures in a ledger, now it is represented by blips in cyber-space.

I am not for one moment suggesting that we should abolish cash altogether, far from it, but although ordinary people – shoppers, consumers – and especially your local small traders – although they all use cash for day to day transactions, the goldsmithing function of the banks – if I may put it like that – being not quite obsolete, this is the only reason any of us really needs to use a bank, or building society at a local level.

At a higher level, this function is hardly needed at all, the fact that credit has no tangible existence means that you don’t need safes, strongrooms or elaborate physical security. And you don’t need palatial offices in the City of London either. Provided you have unimpeachable on-line security, you can run most of the banking system from desktop PCs; most bank clerks could actually work from home.

One of the objections to this will be that banks need to adopt a hands on approach; they have to assess the creditworthiness of their borrowers, and so on. This is based on the fallacy that banks lend the money of their depositors – people deposit money with the bank, and this earns x percent interest; other people borrow money, and pay the bank x + y percent interest; and the bank’s profit is derived from the differential interest rates – less its overheads.

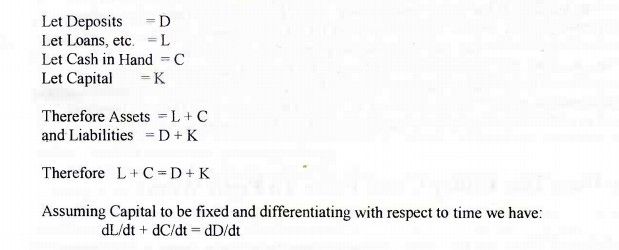

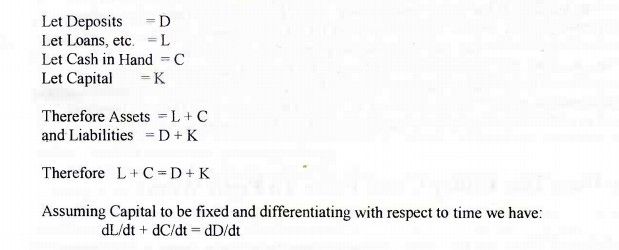

That is a myth that was exploded by Major Douglas back in the 1920s. Banks do not in fact lend the money of their depositors, rather the money stays on deposit, and they create credit; this credit goes out to borrowers, and is used in turn to create further deposits – and money – and when the creditors repay their loans, this new money is cancelled out of existence, except for the interest, which is the bank’s profit.

Up until fairly recently, the reality of this process was admitted only in specialist textbooks, if at all, but the recent adoption of so-called quantitative easing has led to its general acceptance. For the mathematically minded among you – including you, Sabine – here is the proof given by Major Douglas himself.

[Screenshot of the Douglas equation extracted from MONEY: Medium Of Exchange Or Debt?]

What this means is that as far as ordinary people are concerned, the banks should be used purely as a secure store for their money – the goldsmithing function again – and that the creation of credit should be separated from depositors entirely. Ideally the banks should not be permitted to create credit at all, certainly not for public spending; this should be done by the government, who should issue it debt-free. John Tomlinson has dealt with this subject at some length in his book Honest Money. Be that as it may, the banking system as it exists is largely a white elephant, and if nothing else, most bank premises could be closed down as the overwhelming majority of bank-related financial transactions can be carried out on-line.

Now, let us look at some of the other functions carried out by banks, and other financial institutions. One of these is dealing in shares. Let’s take straight share dealing for the moment. If you want to deal in shares you have to go to a stockbroker, which can be a bank. Although it is referred to as investing, dealing in shares is often more akin to gambling, hence the expression “playing the stock market”. The banks and stockbrokers who deal in shares may well be gambling, but they are gambling with other people’s money – yours if you patronise them. Gambling with other people’s money is the best way to gamble, because if they lose, they don’t actually lose, although they always win, because they charge fees, and commission, for their services. But are stockbrokers necessary? The answer is surely no. Wouldn’t it be better to abolish them altogether, and allow people to trade shares directly?

It would require nothing more than a simple Act of Parliament to abolish stockbrokers and the Stock Exchange as we know it. Rather than buy from brokers, investors could trade shares directly with other shareholders. Or they could trade them on a gaming website such as Betfair, which already offers spread betting. The fees charged by an on-line share exchange of that nature would be a tiny fraction of that charged by stockbrokers.

Then there are managed funds; many investors don’t invest in shares directly, but turn over their money to managed funds such as unit trusts. The rationale behind this is to leave it to the professionals, for surely they know what they are doing. The Great Depression, Black Monday, and most recently the misnamed Credit Crunch should disavow most savvy investors of that notion. The best evidence indicates that neither fund managers, nor economists, nor bankers, nor even the government really knows what it is doing when it comes to playing the stock market, certainly they don’t know better than the man in the street, the housewife, or even the average parrot. Yes, I did say parrot.

Earlier this year, an on-line stock market investment advice service in Korea ran a competition which pitted ten investors against one another; one of those investors was a parrot. And the parrot won. This was not a one-off. The reason for this appears to be that the parrot traded rather infrequently.

If this sounds surreal, the financial journalist Tony Levene had the answer to that in his book The Shares Game, which was published way back in 1987. And the answer really is so simple, leaving aside the wisdom of investing in a particular company, or how well any individual company does, the average investor or fund manager – quote unquote – cannot beat the market because the market is made by these funds by virtue of their size. Okay, occasionally somebody will pick a spectacular winner, perhaps by investing in penny shares, but that is really rather akin to buying a lottery ticket every week or every month. Somebody will always hit the jackpot. Every time you buy and sell shares you’re losing money on spread and commission. So buy them, and hold onto them.

So, we don’t need stockbrokers, but the biggest benefit to the economy and to all of us – the working classes, the middle classes, and entrepreneurs, would come from the abolition of managed funds: unit trusts and similar funds, and in particular hedge funds. Obviously, most people who invest in such funds think they make them money. While it is true that over the long term, if you invest in unit trusts, you will make money, this is not because the fund managers are good at their jobs, it is because the companies that make up the stock market make money. By and large. The same applies here as to ordinary shares, as Mr Levene concluded, and the parrot demonstrated. But with managed funds, including pension funds, the investor has even bigger obstacles to overcome.

To begin with, these funds are managed, and fund managers earn – or rather are paid – enormous salaries and bonuses. These funds have expensive offices in the City, and they advertise. Before they make a penny for their investors, all those overheads have to be paid. On September 26, a BBC programme reported that the value of a pension fund is reduced by up to 38% by a modest annual management fee of 1.5%. Think about it, that is over a third of your pension gone, down the drain, and into the pockets of parasites who are paid six figure salaries to play games with the money you have set aside for your retirement.

Do we need the City? Do we need banks? If we need them at all, we need far fewer: fewer financial institutions, fewer parasites, fewer overheads. They don’t need these palatial offices and the astronomical overheads associated with them. They could all, or most of them, be closed down, and the buildings put to alternative use.

The banking system and most of the so-called finance and investment houses could be run far more effectively and efficiently and cheaply with perhaps twenty percent of the current workforce, and could be totally decentralised. That would mean far fewer commuters, less trains, or less crowded trains and buses, less traffic on the roads, even less air travel.

Now, at this point I can hear somebody shouting “Won’t that cause unemployment?”

The short answer is no. When society can produce the same goods and services more efficiently, or more goods and services much more efficiently, there is a net gain in wealth. The problem with the current financial system is that money is distributed largely by wages, salaries and dividends, a method that is clearly inadequate in a world where increasing quantities of consumer goods can be produced, and are produced, by a shrinking workforce thanks to automation, the transistor, and now the silicon chip and the nano-revolution.

For the solution to the mythical problem of unemployment, check out my FinancialReform website, or some of the videos on this website produced by other people active in the financial reform movement; if you use the search term “basic income” you’ll find plenty of short films to mull over for the rest of the Credit Crunch, including one by my fellow right wing extremist Bishop Desmond Tutu.

Download This Document In Portable Document Format

Back To Speeches Index

Back To Site Index