Bitcoin has been in the news recently, though not necessarily for the right reasons.

If you haven’t heard of Bitcoin, this revolutionary concept is a digital peer-to-peer currency that was developed initially by Satoshi Nakamoto, who may or may not be Japanese; no one seems to know for certain who he is, and his identity is not important. He spelled out the concept in 2008, and the network was up and running the following year.

Although most people have heard of digital currencies, Bitcoin is not widely known; I heard of it first only on September 29 at a meeting in London – of which no more anon. Whoever Mr Nakamoto really is, he has certainly laid the foundations for something revolutionary. Bitcoin has been hailed as the end of state controlled money, but is it safe to use? I ask that question because I have been bitten before, but before turning to E-Gold, I should point out that it is not the state that controls the money supply, whatever the alleged role of our central banks. The Federal Reserve is not the central bank of the United States; as Murray Rothbard pointed out echoing others before him, it is a privately owned cartel. The same can be said of the Bank of England, whoever is nominally in charge.

Now, to E-Gold. This began trading way before Bitcoin, and styled itself “Better money since 1996”. I heard of E-Gold through autosurfing, something I took up with enthusiasm. The less said about autosurfing the better, suffice it to say it is now dead; it was a scam, although many perhaps most of the people running it didn’t realise it was a scam, and the only way it could continue was as a Ponzi scheme.

Many autosurfs took payment in E-Gold; some traded only in E-Gold, so I got into it, not in a big way, but I intended to, until June 2006 when I spent $200 on E-Gold, paid out $10, then the following day when I checked my account, it was down to a few cents.

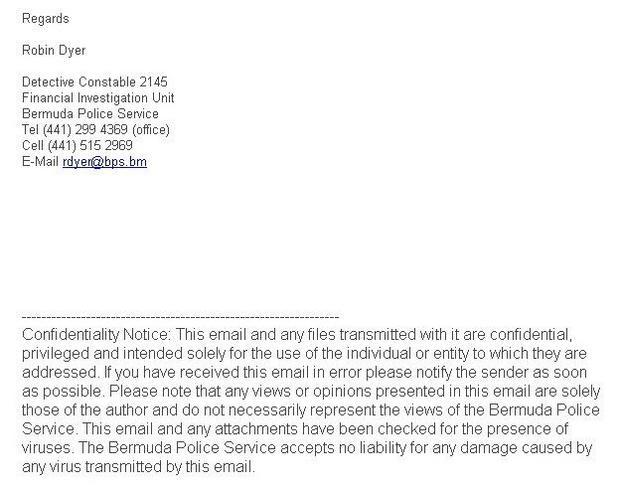

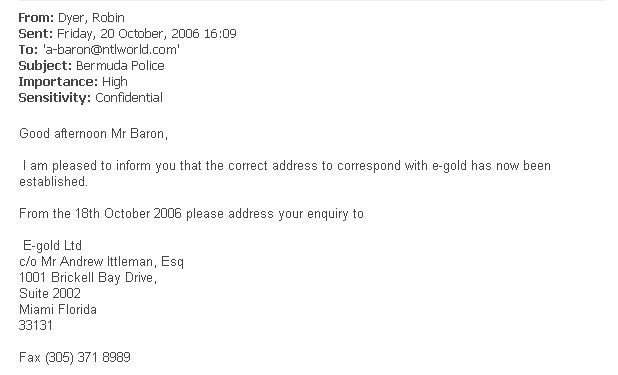

I changed ISPs shortly, so no longer have most of the resulting e-mails. (if you want to know why, the short answer is Richard Branson). However, the two e-mails I retained can be seen below. They are from a well spoken and enthusiastic police officer in Bermuda, who also telephoned me. From his accent he sounded like a recent secondment from England.

As soon as I saw my account had been drained, I fired off an e-mail to E-Gold. The response I received said basically, it was my own fault, that I had allowed myself to be tricked by a trojan, a virus or some such. The response also gave me instructions about how to avoid this sort of thing in future. What I really wanted of course was the identity of the thief; I had only his account name, zhdong, or something like that. E-Gold told me that in order to obtain that, I would have to serve a warrant on the company, and gave me an address in Bermuda. For someone of limited means thousands of miles away, this would have been totally impracticable – something you should always bear in mind when you deal with any individual or organisation on-line, however big, however reputable they appear or are.

This is where Bermuda Police officer Robin Dyer came in. His two e-mails are self-explanatory; I contacted the Governor of Bermuda, who passed on my correspondence to the Deputy Governor, and Mr Dyer replied. The bottom line is that E-Gold lied to me. Why would they do this?

E-Gold has now been shut down; you can read an in-depth and incisive article about the man behind it on Wired. Whether or not Douglas Jackson is an idealist who was taken for a ride by crooks is not the point. The point is – well, there is more than one. Firstly, your money was not safe with E-Gold; as with any other so-called hard currency, you had no guarantee it was actually backed by gold or by anything; the only way you ever have that guarantee is if you literally sleep with the stuff under your mattress.

Your E-Gold or other electronic currency can be stolen – as happened to me and as has happened to countless people before and since, and in much larger amounts. If it is stolen, you can’t trace it. A third and equally important point is that although you can’t trace it, the authorities can, indeed, in the Wired article, it is stated explicitly that on his own initiative, Douglas Jackson went through his customers’ records, sorted out the ones that he considered to be engaged in criminal activity, and handed them over to the legal authorities.

Whether or not this is a bad thing is beside the point, obviously where serious fraud is involved – as in the Asil Nadir case – or perhaps a civil case in which a plaintiff has obtained a substantial judgment, it is only fit and proper that the authorities should be able to trace and seize the assets of an individual or a company.

Whether or not you agree with that statement, and whether or not Bitcoin does turn out to be the greatest thing since sliced bread, remember and learn from the rise and fall of E-Gold. And all the suckers who lost money through it.

A screengrab of an e-mail from Robin Dyer of the Bermuda Police – top part.

A screengrab of an e-mail from Robin Dyer of the Bermuda Police – bottom part.

A screengrab of an e-mail from Robin Dyer of the Bermuda Police – top part.

A screengrab of an e-mail from Robin Dyer of the Bermuda Police – bottom part.

[The above op-ed was first published October 7, 2012.]

Back To Digital Journal Index