The figures for 2009

On hearing of the apparently extortionate rates of interest charged by the payday loan company Wonga, the Archbishop said he would shut it down. Then, embarrassingly, one of his underlings appears to have whispered in his ear “Actually boss, we helped finance this firm”.

Obviously he was totally unaware of this, and if he realised how the Church of England’s investment portfolio is managed, he would probably if not shut that down, then totally reform it. The Church must invest ethically, he said.

The Church’s Ethical Investment Advisory Group “recommends against investment” in companies which make more than 3% of their income from pornography, 10% from military products and services, or 25% from other industries such as gambling, alcohol and high interest rate lenders.

Leaving aside the at times elastic definition of pornography, it is clearly impractical if not impossible for a big organisation to avoid every “undesirable” investment due primarily to the interlocking nature of the business world; Richard Branson’s Virgin Group for example does everything from ferry passengers around Britain and the world to manufacturing soft drinks. What though of companies that are 100% concerned with gambling, like the Church of England Investment Fund? If that sounds a dubious statement, consider the following. The 2009 annual report of its pension board can be found here; the 2010 report can be found here; and the 2011 report, here. For the purpose of this exercise though we need consider only three tables from these publications – the same table for each year, as will be seen from the screengrabs below.

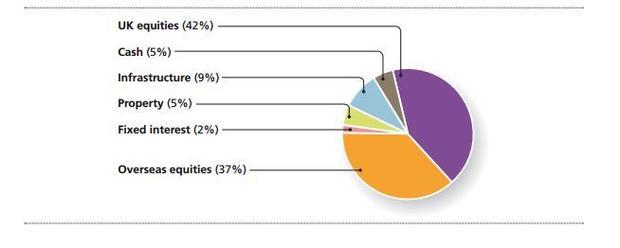

The figures for 2009

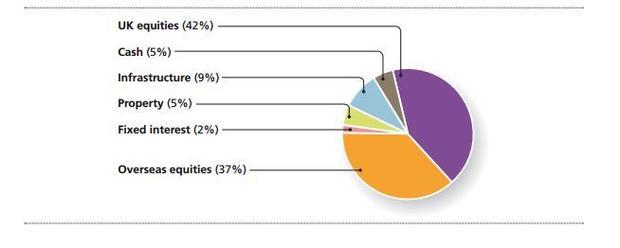

The figures for 2010

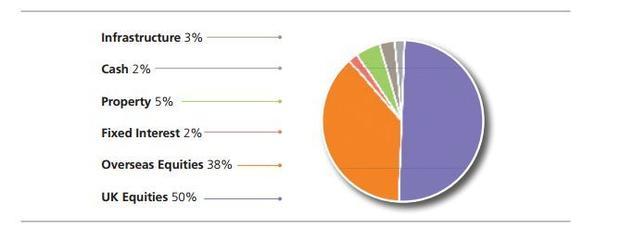

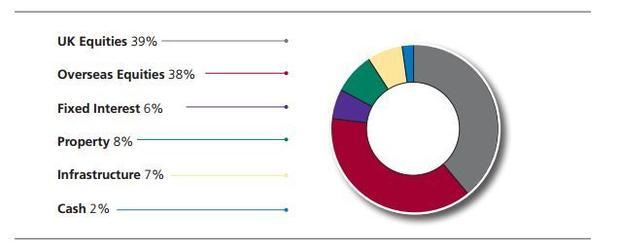

The figures for 2011

In 2009, the Church held 42% of its charitable funds in equities (shares); 50% in 2010; and 39% in 2011. The other percentages do not appear to have changed much, but leaving aside market fluctuations, the fund managers have done a fair amount of trading on the Stock Exchange. Many so-called managed funds do considerably more, as do investment banks (casino banks to you).

These misnamed professional investors trade all day long, day in, day out, hoping to buy low and sell high. Clearly, they can’t all “win” unless the stock market continues to rise, which it can do for only a relatively short time. And of course, what goes up, must come down. Even the most established, largest and most reputable companies can and do go to the wall, the letters HMV spring to mind here; how many so-called professionals saw that coming?

Of course, one can take this argument to extremes, a compulsive gambler might argue we take risks every day. If you leave your house you could be stabbed to death by a lunatic or run over and killed crossing the street, and if you stay home, you could be trapped and killed in a fire not of your own making, life is a gamble, as indeed it is. But, and this is the big but, there is a massive difference between rational investment decisions and playing the stock market – or the bond market, property, etc. Perhaps the Church of England should start its own companies and invest totally in them, as social enterprises? Whatever, although the Archbishop means well, he should give some serious thought to the real issues and problems before he spouts off at payday loan companies or any other commercial enterprise.

[The above article was published originally July 27, 2013. The three screengrabs were deleted almost at once.]

Back To Digital Journal Index